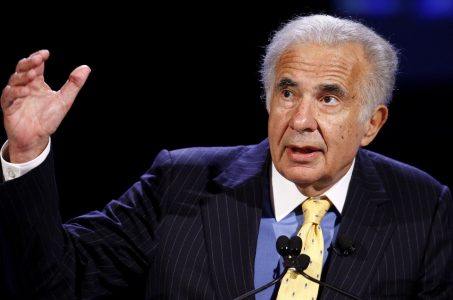

Wynn Resorts Stocks Now a Risk, Gaming Analysts Say, As Steve Wynn Sex Scandal Repurcussions Hit Hard

Posted on: January 29, 2018, 11:45h.

Last updated on: January 29, 2018, 12:09h.

Investing in Wynn Resorts, publicly traded on NASDAQ and China’s Hong Kong Stock Exchange, has become a riskier endeavor in the wake of the sexual misconduct allegations surrounding the company’s billionaire founder and CEO, Steve Wynn.

That’s the view of several key industry analysts following a weekend where the finance chair of the Republican National Committee (RNC) turned in his resignation in the aftermath of the sensational Wall Street Journal report that hit the news on Friday, turning the casino industry on its ear.

In the damning WSJ exposé, in which the news site claimed to have interviewed more than 150 former employees, numerous female workers asserted that Wynn made inappropriate sexual advances towards them on company property over the span of several decades.

The 76-year-old Las Vegas tycoon, according to the claimants, forced numerous masseuses to perform sex acts on him, and he allegedly had unwanted intercourse with a manicurist in 2005, which was followed by a rumored $7.5 million payout.

That employee is reported to have gone to HR very upset following the alleged incident, but no public action was taken at the time on behalf of the unnamed woman.

Stock Impact Significant

News of that settlement isn’t breaking news. In its own financial note, Deutsche Bank said “reports of the settlement were present for some time, including as recently as the end of December when a Bloomberg article was published regarding it.

“We believe some of the reaction in shares stems from the significant level of detail provided in the Wall Street Journal article, which in and of itself has likely created a somewhat emotional market response,” Deutsche Bank concluded.

Morgan Stanley opined Wynn stock and earnings could continue to rise despite the scandal, but admitted that “management continuity is important.”

Though Steve Wynn and company higher-ups are denying the allegations, gaming and financial analysts believe the scandal could damage the casino company’s reputation regardless.

Union Gaming, an investment and advisory firm focused on the global gambling industry and with offices in Macau and Las Vegas, has now downgraded Wynn Resorts Macau from “buy” to “hold.”

In a note, Union Gaming analyst John DeCree explained, “We believe valuation was already lofty and expect the shares to be re-rated … with near-term headline risk related to the allegation.”

Wynn Resorts closed at $200 on January 25. When the news broke the following the day, the stock fell 10 percent to $180. Wynn Macau behaved similarly. Both stocks lost further value with Monday morning trading.

Company Backing Up

While Steve Wynn’s reputation is taking a beating this week, but he still has the support of his company.

In a letter to employees, Wynn Las Vegas President Maurice Wooden stated, “We are all supportive of Mr. Wynn and his leadership … and we are doing everything we can to protect our employees from these types of attacks and publicity.”

Wooden was referencing the fact that many workers have been contacted by media outlets for comment on the scandal. In his own statement last week, Wynn blamed his ex-wife Elaine for the WSJ report. The Wynns remain engulfed in a bitter post-divorce financial dispute that dates back to 2010.

Prior to the WSJ bombshell, Wynn Resorts had a general analyst recommendation of 4.2 out of 5.0 on Morningstar, which equates to a “buy” rating.

Setting the Standard

Less than 24 hours after the scandal broke, Wynn stepped down as the finance chairman of the RNC.

The casino developer is just the latest male power player to be accused of sexual misconduct in what’s become known as the “Harvey Weinstein effect.” After that Hollywood mogul was found to have sexually abused hundreds of women, the RNC condemned the Democratic National Committee for taking millions of dollars in donations from Weinstein.

Now, the shoe is on the other foot, as the GOP political committee must decide what to do with Wynn’s contributions. Over the weekend, Sen. Lindsey Graham (R-South Carolina) said “if these allegations have merit, I don’t think we should have a double standard for ourselves.”

Related News Articles

Most Popular

FTC: Casino Resort Fees Must Be Included in Upfront Hotel Rates

Genovese Capo Sentenced for Illegal Gambling on Long Island

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

Most Commented

-

UPDATE: Whiskey Pete’s Casino Near Las Vegas Closes

— December 20, 2024 — 30 Comments -

Caesars Virginia in Danville Now Accepting Hotel Room Reservations

— November 27, 2024 — 9 Comments -

UPDATE: Former Resorts World & MGM Grand Prez Loses Gaming License

— December 19, 2024 — 8 Comments -

NBA Referees Expose Sports Betting Abuse Following Steve Kerr Meltdown

— December 13, 2024 — 7 Comments

No comments yet