Fontainebleau Hail Mary: Struggling Resort to Buy Site Next Door for $112.5 Million

Fontainebleau is throwing one of the most expensive Hail Mary passes in Las Vegas history. You know it’s a big deal if we’re using a sports metaphor.

The resort’s owner, Jeffrey Soffer, is reportedly buying a five acre parcel across the street from the $3.7 billion Fontainebleau for $112.5 million.

We know why, and you’re about to learn what the phrase “good money after bad” means. Gird your loins.

So, Fontainebleau is gorgeous. We say this a lot. It’s a miracle the place opened. It sat idle for two decades.

The resort’s original developer, Jeffrey Soffer, partnered with Koch Real Estate Investments and opened Fontainebleau on December 13, 2023.

In the first quarter of 2024, Fontainebleau lost $400,000 a day. The lesson: Never open a casino on the 13th of the month.

Anyway, it’s been a rough road for Fontainebleau. The most visible signs of distress are 1) the emptiness of the casino, 2) the loss of a dozen key executives. In its first six months of operation, Fontainebleau lost (either through firings or resignations) two presidents, COO, CMO, CFO, Chief People Officer, two senior VPs of casino operations and others.

It’s been quieter at Fontainebleau recently, for a couple of reasons. One, Maurice Wooden is president. Two, a havoc-wreaker—Peter Arnell, Chief Brand and Design Officer for Fontainebleau Development—is no longer in the picture.

Then, out of the blue, it’s reported Jeffrey Soffer is buying part of the former Riviera site.

This was surprising news for a number of reasons.

In 2023, the LVCVA sold 10 acres of the Riviera site to a company called 65SLVB for $125 million. 65SLVB is Brett Torino and Paul Kanavos. These are the folks behind Harmon Corner and 63 at The Shops at Crystals. Retail developers.

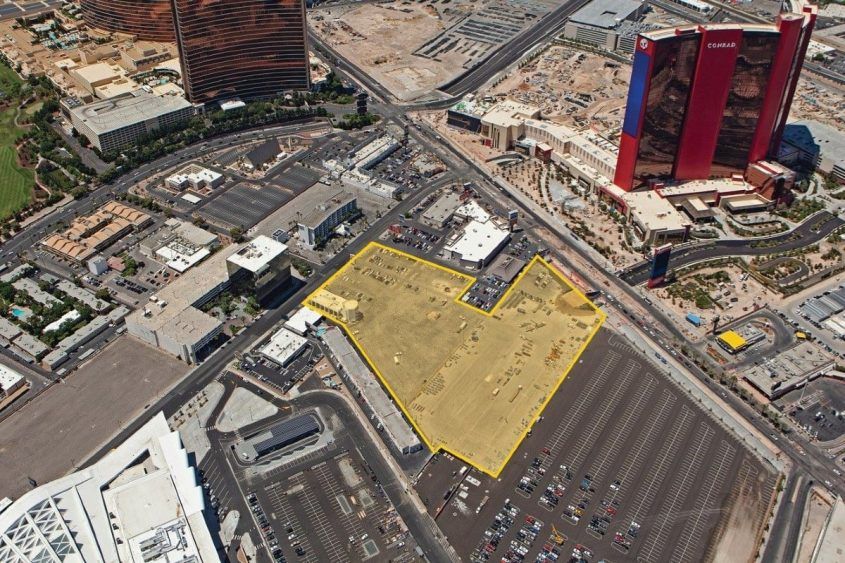

Soffer is buying (subject to rubber stamp approval blah-blah-blah from the LVCVA in July 2024) the “back” five acres of the parcel, in other words, the part not on Las Vegas Blvd.

If you do the math, Brett Torino and Paul Kanavos are looking like geniuses, because they recouped nearly their entire investment by selling the least valuable part of their parcel. They still have plenty of room to build some boring retail down the road. Sorry, “jaw-dropping, immersive shopping experience that will change the face of human commerce and echo for an eternity.”

So, why is Fontainebleau spending so much money on a parking lot?

The answer is high roller suite inventory.

The plan is for Fontainebleau to build a bridge to a new structure that will cater to elite gamblers. Think the Mansion at MGM Grand and Fairway Villas at Wynn. If you don’t recognize those places, it’s because we normal humans can’t afford to stay there. Even if you have the money, the highest end suites in Las Vegas can’t be reserved by commoners, they are given away free to whales.

Fontainebleau is spending (wasting) $112.5 million (a shit-ton) because they’re convinced (deluded) the reason they haven’t been able to steal big players from other casinos (Wynn) is they don’t have the suite product to attract them.

They haven’t said that’s the reason for buying the parcel, but that’s the reason.

Fun fact: Justin Timberlake was paid $6 million to perform at Fontainebleau’s opening night gala. That night, he stayed at Wynn. Awkward.

At the moment, Fontainebleau is scrambling to solve for a simple question: “Why isn’t this working?”

The answer is almost as simple: Las Vegas isn’t Miami, “build it and they will come” isn’t tethered to reality. Oh, and no foot traffic.

Speaking of droning, we’ve droned on endlessly about Fontainebleau’s lack of casino and hotel databases, along with the fact Fontainebleau has zero experience in the casino resort business.

The massive losses have, of course, resulted in finger-pointing and chaos.

If your resort isn’t drawing foreign gamblers, fire the person responsible for going after them.

Well-regarded whale hunter Marika Cardellino (Sr. Vice President Latin Europe Middle East) has been fired from Fontainebleau, we’re told.

— Vital Vegas (@VitalVegas) June 9, 2024

If gaming revenue isn’t meeting unrealistic expectations, build villas!

As the kids say, oy.

Q1 2024: $62 million casino revenue, $57 million hotel revenue, $88 million in food and beverage, $2 million retail, $8 million miscellaneous revenue, so total net revenue was $192 million. Comps were $17 million, $1 million a day payroll, royalty fee of $4 million and brand fee of $1 million, total operating expenses, $222 million, for a three month loss of $36 million.

That’s without paying interest on the resort’s financing, as that doesn’t start until mid-2025.

In Q1, net revenue of $191.6 million fell short of budget by $67.6 million, or 26%.

If things don’t change, Fontainebleau is set to lose about $500 million this year.

Or as one source put it…

Source who knows things believes Fontainebleau will be out at Fontainebleau within a year. Koch's stake is 75%, interest payments start mid-2025. Bookmark this Tweet, or whatever the kids are doing now.

— Vital Vegas (@VitalVegas) June 7, 2024

It’s clear many of the decisions being made at Fontainebleau aren’t being made based upon “facts,” but rather optimism with a smidge of ego.

Jeffrey Soffer is really successful, so he’s certainly not dumb, but let’s just say this latest move doesn’t seem particularly well thought through. What do rich people do when they encounter problems? They spend more money to fix them.

Soffer said in a statement, “Almost six months into operations, we are already seeing positive and encouraging results for Fontainebleau Las Vegas.”

It’s unclear if Jeffrey Soffer has actually seen the financials for Fontainebleau. We have.

Did he see the part about “all other verticals suffering from lower-than-budgeted occupancy,” about 50% lower than projections in January and March 2024?

The intern at our paper of record dismiss the challenges at Fontainebleau as just “needing more time for the resort to get its footing.” Mostly because the Review-Journal doesn’t have actual journalism anymore.

The parcel being purchased by Fontainebleau bumps up against another parcel we’ve heard will be a significant development from Siegel Group. The site includes Siegel’s Bagelmania. And the indoor skydiving place. It all adds up to the yellow thing below.

While we don’t care all that much about bagels, we are very interested in seeing the damn rendering already for the project that will include a casino.

Soffer’s purchase of an adjoining parcel raises lots of questions. Will Fontainebleau be around long enough to see the parcel developed? If they build it, will the whales come? Has Jeffrey Soffer lost his damn mind? Whose money is paying for the parcel (is it all Fontainebleau Development money, or is their contribution 25% like the hotel)? Is the purchase of this parcel like buying new deck chairs for the Titanic? Is $112 million being wasted, or can they make it up on the back end?

Of the parcel. Because it’s the back parcel. Please keep up.

Also on the horizon for Fontainebleau: Pending Wynn lawsuit for alleged poaching. Maurice Wooden license approval drama. Insider trading troubles gaming regulators may look into if they wake up from their ongoing naps. Jeffrey Soffer top secret wedding at Fontainebleau, possibly on July 4 weekend. (Get on confirming that scoop, Johnny Kleptometes! We can’t do everything for you.) Rollback of paid parking, probably. Better advertising and social marketing soon. Tier matching extended. Awesome nachos at the Tavern. One of the most beautiful casinos in the history of Las Vegas.

Bottom line: Glorious drama worthy of a Las Vegas casino. The suspense is terrible, we hope it’ll last.

If you read that last sentence and thought Willy Wonka rather than Oscar Wilde, you probably went to public school in Nevada. Yeah, we said it. Like anyone who doesn’t work in P.R. at Fontainebleau reads all the way to the end of our stories, anyway.

Leave your thoughts on “Fontainebleau Hail Mary: Struggling Resort to Buy Site Next Door for $112.5 Million”

54 Comments